Difference Between FHA Back To Work Versus Traditional FHA Loans

This BLOG On Difference Between FHA Back To Work Versus Traditional FHA Loans Was UPDATED On January 6th, 2019

The FHA Back To Work Extenuating Circumstances Due To An Economic Event Mortgage Loan Program has been discontinued by the Federal Housing Administration (FHA). The Difference Between FHA Back To Work Versus Traditional FHA Loans was the waiting period requirements after the following:

Waiting Period To Qualify For FHA Loans after the following economic events:

- Chapter 7 Bankruptcy

- Recorded Date After Foreclosure

- Recorded Date After Deed In Lieu Of Foreclosure

- Qualifying For FHA Loans After Short Sale

The Difference Between FHA Back To Work Versus Traditional FHA Loans is that with the Back To Work, the waiting period got reduced to one year after bankruptcy, foreclosure, short sale, deed in lieu of foreclosure rather than the standard waiting period to qualify for FHA Loans on traditional HUD Guidelines.

Waiting Period To Qualify For FHA Loans After Bankruptcy & Housing Event

HUD, the parent of FHA, has a mandatory waiting period to qualify for FHA Loans after bankruptcy and foreclosure.

Here are the waiting period requirements after bankruptcy and/or housing event to qualify for FHA Loans:

- 2 Year Waiting Period After Chapter 7 Bankruptcy discharged date

- Mortgage Borrowers can qualify for an FHA Loan one year into a Chapter 13 Bankruptcy Repayment Period with Trustee Approval

- There is no waiting period to qualify for FHA Loans after a Chapter 13 Bankruptcy Discharged Date

- There is a three-year waiting period to qualify for FHA Loans after a short sale

There is a three-year waiting period to qualify for FHA Loans after the recorded date of a foreclosure and/or deed in lieu of foreclosure.

What Was The FHA Back To Work Mortgage Program

Again, this article on Difference Between FHA Back To Work Versus Traditional FHA Loans Is An Older Blog That Is UPDATED On November 3rd, 2017. The FHA Back To Work Program Is No Longer In Existence And Has Been Discontinued. This BLOG Will Remain Published & UPDATED for Archival Purposes. The Gustan Cho Team at USA Mortgage has NON-QM Loans in lieu of the FHA Back To Work.

HUD’s brand new FHA Back to Work Extenuating Circumstances due to Economic Event was effective August 15, 2013, and makes homeownership possible to home buyers who have had a prior bankruptcy and/or foreclosure by shortening the mandatory waiting period to a one year waiting period.

- Under normal circumstances, a home buyer needs to wait a two-year mandatory waiting period after the discharge date of a bankruptcy

- The is a three year waiting period after the recorded date of a foreclosure or deed in lieu of foreclosure to qualify for FHA Loans with traditional FHA Loans

- There is a three-year waiting period to qualify for FHA Loans after the date of a short sale

- However, with the FHA Back to Work Extenuating Circumstances due to an economic event, the home buyer could have qualified for FHA Loans after one year after the discharge date of bankruptcy or after the recorded date of the foreclosure or deed in lieu of foreclosure

- It also shortens the waiting period from three years to one year from the date of the short sale per their HUD’s settlement statement

Again, the FHA Back To Work Mortgage Program is no longer in existence. NON-QM Loans has replaced the FHA Back To Work Mortgage Program.

Qualifications For Back To Work Extenuating Circumstances

In order to qualify for HUD’s new FHA Back to Work Extenuating Circumstances due to Economic Event the borrower needs to meet the following qualifications:

- Have been unemployed, or underemployed for at least six months prior to an economic event

- Economic Event needs to be either filing bankruptcy or the initiation of foreclosure/short sale proceedings which has affected the borrower’s household income of at least 20% or more

- The borrower needs to complete a one-hour HUD-approved housing counseling course

- Have had no late credit payments for the past 12 months or since the bankruptcy and/or foreclosure

- FHA Back to Work Extenuating Circumstances due to economic event mortgage lenders like to see re-establish credit

- Have rental verification

The borrower also needs to prove that he or she has a stable income source and that the income source will continue for the next three years.

Main Difference Between Back To Work Versus Traditional FHA Loans

HUD’s new FHA Back to Work Extenuating Circumstances due to Economic Event is no different than any other FHA loan programs other than these two main reasons:

- Shortens the waiting period after bankruptcy, foreclosure, deed in lieu of foreclosure, short sale

- Manual Underwriting: Manual Underwriting Guidelines On FHA Loans Applies

Other Difference Between FHA Back To Work Versus Traditional FHA Loans Are As Follows:

- Mortgage borrowers will get the same mortgage rates and terms depending on credit scores

- There is a minor Loan Pricing Adjustment for being a manual underwrite

Underwriting Difference Between FHA Back To Work Versus Traditional FHA Loans

However, there is a Difference Between FHA Back To Work Versus Traditional FHA Loans when it comes to underwriting:

- All FHA Back to Work Extenuating Circumstances due to Economic Event mortgage loans are manually underwritten

- The reason it is manually underwritten is that these mortgage loan applications will not get a DU Automated Underwriting System approval by Fannie Mae

- The front end debt to income ratios are capped at 31%

- The back end debt to income ratios are capped at 43%

- The mortgage loan underwriter has a lot more discretion in underwriting the file and it will be the underwriter’s decision whether to approve or deny the mortgage loan application.

- The most important factor on all FHA Back to Work Extenuating Circumstances due to economic event mortgage loan applications will be the detailed letter of explanation the borrower needs to write and sign concerning the extenuating circumstances.

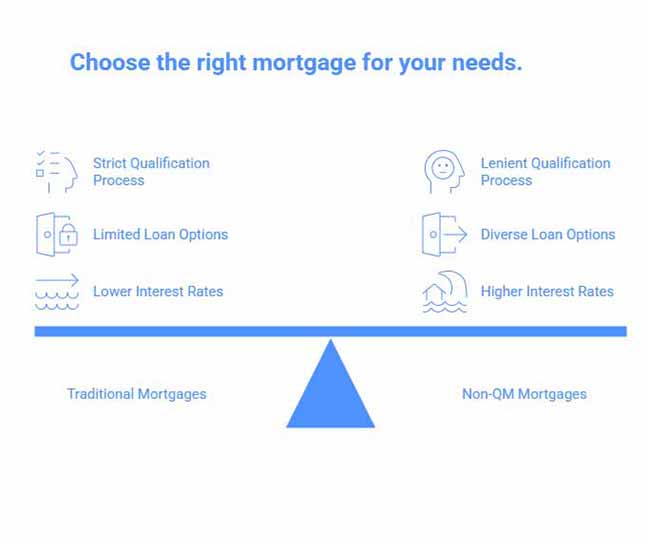

Again, FHA Back To Work Mortgage Program is no longer in existence. The new NON-QM Mortgage Loan Program is the replacement of FHA Back To Work and requires no waiting period after a housing event.

No Waiting Period After Housing Event With NON-QM Loans

NON-QM Loans have no waiting period requirements after the following:

- No Waiting Period After Foreclosure

- No Waiting Period Requirements After Deed In Lieu Of Foreclosure

- No Waiting Period Requirements After Short Sale

- One Year Waiting Period Requirement After Chapter 7 Bankruptcy

The down payment requirement is between 10% to 20%. Down Payment requirement depends on the mortgage borrower’s credit scores. The minimum credit score to qualify is 640.

Homebuyers who need more information on NON-QM Loans, please contact Gustan Cho Associates at 800-900-8569 or text us for faster response. Or email us at gcho@gustancho.com.