This guide offers a complete overview of home purchase loans in 2026, both conventional and non-QM (Non-Qualified Mortgage) loans. It delves into the qualifications, benefits, drawbacks, and distinctions to assist you in selecting the optimal loan for your unique situation. Whether you are a first-time home purchaser, seasoned homeowner, or investor property owner, this guide empowers you with the insight to make good financial choices in today’s dynamic mortgage environment.

Understanding Home Purchase Loans

Home purchase loan is a financial product that enables individuals and households to buy residential real property. Home purchase loans are typically repaid over a period of time, e.g., 15 or 30 years, and carry interest, which may be fixed or may vary over time. The credit worthiness of a borrower is ascertained by the lenders depending on income, employment, credit history, and debt-to-income ratio (DTI). Home purchase loans are typically divided into traditional qualified mortgages and non-qualified mortgages.

Traditional Home Purchase Loans

Conventional, or “qualified,” home loan acquisitions have strict federal agency lending regulations. They are generally insured by Fannie Mae, Freddie Mac, the Federal Housing Administration (FHA), the Department of Veterans Affairs (VA), or the Department of Agriculture (USDA).

Traditional Loans:

- Traditional loans are the most common type of traditional mortgage.

- They are not insured by the government and usually require a 620 minimum credit score and a down payment of 3% to 20% or more.

- If the down payment is less than 20%, private mortgage insurance (PMI) is usually required in order to protect the lender in the event of default.

FHA Loans:

- Government-insured FHA loans are the best option for first-time buyers or individuals with poor credit scores.

- They usually demand a credit score of 580 and a down payment of 3.5%, which makes it easier to become a homeowner.

- FHA loans also have more lenient DTI ratio requirements.

VA Loans:

- Offered to active military, veterans, and spouses, VA loans provide 100% financing, no PMI or down payment.

- VA loans also come with reduced interest rates, and since they are backed by the government, they can be financed.

USDA Loans:

- Also government-insured, USDA loans are available to buyers in eligible rural and suburban areas.

- They are 0% down but are limited by location and income.

Explore Non-QM & Traditional Home Purchase Loans – Find the Right Fit for You!

Apply Now And Get recommendations From Loan Experts

What are Non-QM Home Purchase Loans?

Non-QM loans are exempt from federal regulations that set qualified mortgage standards. Conventional loans don’t meet qualified mortgage’s stringent underwriting and documentation requirements, as opposed to non-QM products. But they are compliant with consumer protection regulations and are therefore legal and suitable for the majority of borrowers.

Non-QM loans are originated to borrowers outside the normal lending grid, such as self-employed professionals, business owners, real estate investors, or retirees that use assets to create income. They can also be applied to borrowers with credit issue histories, such as foreclosures or bankruptcies, or lower credit scores.

Types of Non-QM Home Purchase Loans

The need for non-QM loans has increased to serve diversified borrower profiles, and niche products have therefore emerged:

Bank Statement Loans:

- They are self-employed loans, and they allow the borrowers to qualify for the loans without the presentation of W-2 forms to confirm income.

- Bank statements for business and personal use are used to confirm income.

Asset-Based Loans:

Loans consider a borrower’s asset holdings, such as retirement accounts and stocks, rather than income to qualify them.

DSCR Loans:

- The most popular among real estate investors, DSCR loans are dependent upon the potential for cash flow of the property.

- Provided the rental income is sufficient to cover the mortgage, the borrower is approved with minimal documentation of personal income.

Key Differences Between Traditional and Non-QM Loans

The primary differences between non-QM and conforming loans are documentation requirements, qualification requirements, and interest rates. Conforming mortgages have simpler qualification processes and lower interest rates for people with straightforward financial histories that are acceptable under the rules of the agency. Non-QM loans are less restrictive but will carry higher interest rates since the lender is assuming greater risk.

Conventional loans require lengthy documentation, such as tax returns, asset documentation, and pay stubs. Non-QM lenders are able to utilize alternative documentation, which may be asset statements, 12 to 24 months bank statements, or even accountants’ letters.

Pros and Cons of Each Loan Type

Traditional loans are ideal for those who meet strict guideline requirements, offering better rates and lower long-term expenses. They might not be offered to individuals with other credit histories or fluctuating incomes. Non-QM loans enable many otherwise disqualified individuals to buy homes but at higher interest rates and potentially higher down payment requirements.

Whether you’re looking for a traditional loan or need the flexibility of a Non-QM

Apply Now And Get recommendations From Loan Experts

Qualification and Down Payments on home purchase loans

Obtaining a mortgage in 2025 is a serious consideration and reflection on several aspects. Credit history, DTI, job history, and overall financial stability are taken into account by the lender. Conventional loans prefer applicants with good credit and stable job history, and the non-QM loans provide an avenue for applicants with more complicated finances.

Down payment requirements vary depending on the type of loan. Non-conventional loans require a minimum down payment of 3%, FHA loans a minimum down payment of 3.5%, and VA and USDA loans a minimum down payment of 0%. Non-QM loans require a minimum down payment of 10% to 30% depending on the credit worthiness of the borrower and loan program.

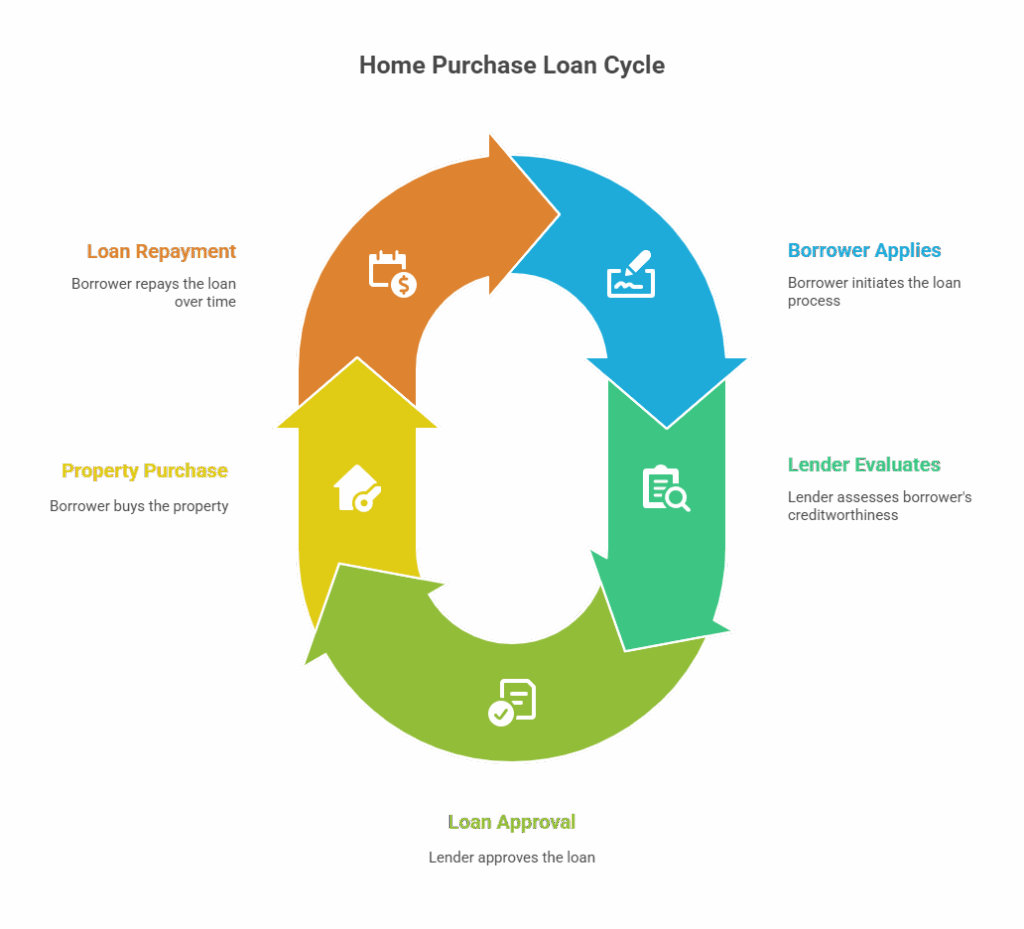

The Home Purchase Loan Application Process

The process of applying for a mortgage typically begins with pre-approval, in which lenders review your finances and credit to determine your eligibility for a specific amount of loan. Once you have found the home you wish to purchase, you will need to apply for a full loan and provide supporting documentation. The lender will order an appraisal to determine the value of the property and forward the application to underwriting to obtain final approval. The last steps are loan approval and closing, in which you will sign documents necessary to finalize the purchase.

Market Trends and Interest Rates

Mortgage rates change based on economic, inflationary, and Federal Reserve policy. Rates in 2025 are moderate but fairly stable. Conventional loans give better terms to good-credit borrowers, but non-QM loans, which have less stringent requirements, offer more in the form of higher rates to offset the greater risk. Non-QM loans, even at higher rates, remain a major vehicle for the underserved markets.

Working with a Mortgage Broker vs. a Lender

Selecting the most advantageous lender is important. Brokers generally have access to more loan programs and lenders, enabling them to shop for the best terms and rates. Direct lenders can provide streamlined processing but with less product choice. Whatever your selection, examine the loan estimate carefully and ask about rate lock options.

Guidance for First-Time Home Buyers

First-time homebuyers must enhance their credit score and make a down payment. Review your budget to see how much you can pay and get pre-approval prior to your home search. Utilize first-time homebuyer programs, which provide discounted mortgage insurance premiums and down payment help.

Mortgage Trends in 2026

Technological advancements are transforming the mortgage industry. Machine learning and artificial intelligence are increasingly automating underwriting and origination processes, making them more efficient for conventional and non-QM lenders. More customization, greater online resources, and more mortgage products are on the horizon.

Frequently Asked Questions

Can I get a mortgage with bad credit?

- Yes, you can acquire an FHA mortgage and specific non-QM mortgages if you have a lower credit score.

Do I have to put 20% down?

- No, there are several loan programs that have less than 20% down, and some of them have 0% down.

Are non-QM loans safe?

- Yes, when originated by prudent lenders, they are entirely compliant with all consumer protection regulations.

Can self-employed individuals get a mortgage?

- Yes. Non-QM loans have a tendency to facilitate lending to self-employed borrowers through alternative documentation approaches.

How long is the typical processing time for a mortgage?

- With full documentation, it can be 30 to 45 days.

- Can a non-QM loan be refinanced into a conforming loan?

- Yes, especially after you have improved your income or credit score.

Navigating the diverse terrain of mortgage products demands an understanding of the differences between traditional and non-QM loans. Whatever your need for a straightforward conventional loan or a non-QM product with more flexibility, a mortgage exists that fits your financial picture. Consulting with a skilled mortgage professional serves up one-on-one support and can help you make the best decision for your homeownership goals.

Let’s make your homeownership dreams come true with the right loan for your needs!

Apply Now And Get recommendations From Loan Experts