HUD Tax Lien Guidelines To Qualify For FHA Home Loans

This guide covers the HUD Tax Lien Guidelines to qualify for FHA home loans. In homeownership, the Federal Housing Administration (FHA) has long been recognized as a guiding light for individuals aspiring to buy their dream homes. With its commitment to providing accessible financing options and more flexible qualification criteria, the FHA empowers countless prospective homeowners to realize their dreams. Homebuyers and homeowners can qualify for an FHA loan with an outstanding tax lien without having to pay the lien in full, says John Strange of Mortgage Lenders For Bad Credit:

HUD tax lien guidelines allow borrowers with outstanding tax liens to qualify for FHA loans if they have a written payment agreement with the IRS and have made three timely monthly payments. The IRS tax lien does not have to be paid in full.

The FHA loan application process has challenges and frustrations for some borrowers, particularly regarding tax liens and their potential impact on loan eligibility. Tax liens can be tough to navigate, especially when you want to clean up your credit history in preparation for an FHA loan application process. To make it easier for the borrowers to navigate, the HUD put in place tax lien guidelines, which prospective borrowers can follow during their credit rebuilding or loan application process. We will tell you all about it in this article, beginning with what the HUD guidelines state, how they affect your loan eligibility, and the steps you can take to resolve the tax lien and qualify for the FHA loan.

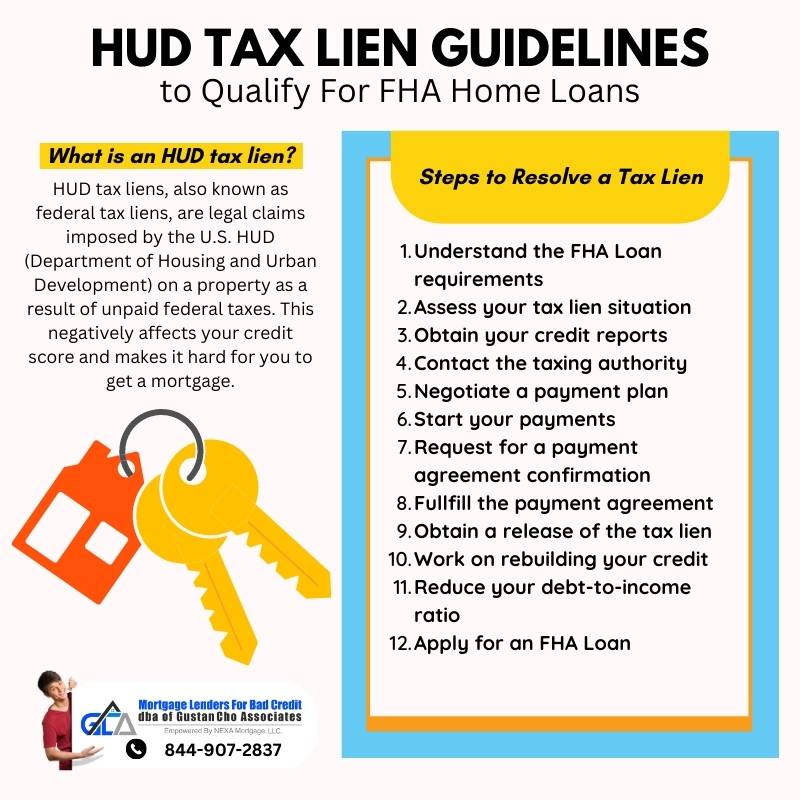

What are HUD tax liens?

In simple terms, HUD tax liens, also known as federal tax liens, are legal claims imposed by the U.S. HUD (Department of Housing and Urban Development) on a property as a result of unpaid federal taxes. When a homeowner fails to pay their federal taxes, the Internal Revenue Service (IRS) or any other taxing authority can file a lien against the property, establishing their legal right to claim the proceeds from the property’s sale to satisfy the outstanding tax debt.

Tax liens can significantly affect property ownership and the borrowers’ ability to obtain financing, including FHA home loans. When an individual applies for an FHA loan, the lender evaluates various factors to determine the borrower’s eligibility, one of which is their financial history, including any outstanding tax liens.

A tax lien signifies a debt obligation that must be resolved before the loan can proceed, which now means it can be a major hindrance in the approval process. And this is why the FHA guidelines were established; to guide the borrower on what needs to be done to qualify for the loan.

The specific HUD tax lien guidelines

Having mentioned HUD tax lien guidelines, you should know that they evolve. But here are some general principles that are typically considered;

- Satisfy the tax lien – the first and most straightforward guideline is fully satisfying the lien before applying for an FHA loan. When you satisfy the lien, it demonstrates your commitment to resolving outstanding tax obligations and eliminates any obstacles that may impede loan approval.

- Repayment plans – in cases where you cannot pay the tax lien in full, the FHA may allow the borrower to enter into a repayment plan with the Internal Revenue Service (IRS). The repayment plan should be reasonable, based on the borrower’s financial situation, and accepted by the IRS. The borrower must provide documentation of the repayment plan, including the agreed-upon terms and proof of adherence to the plan’s payment schedule. You should note that the repayment plan must be in effect before the borrower can proceed with the FHA loan application.

- Demonstrating an Approved Payment History for at Least 12 Months – HUD recognizes that some borrowers may have already established a consistent payment history for their tax lien over at least 12 months. In such cases, borrowers can demonstrate their financial responsibility by providing evidence of timely payments made toward the tax debt. This option allows you to show your commitment to meeting their tax obligations, even if the tax lien remains outstanding. The payment history should be documented and verifiable through statements from the tax authority or other appropriate records.

- Credit score evaluation – the FHA considers the borrower’s credit score when evaluating loan eligibility. But while tax liens can negatively impact credit scores, the FHA may consider the borrower’s efforts to resolve the tax lien and establish a repayment plan. However, remember that a higher credit score increases the likelihood of loan approval.

- Waiting period – Sometimes, a waiting period may be necessary after satisfying a tax lien or entering into a repayment plan. The FHA may require a specific duration to demonstrate a consistent payment history or financial stability before considering the loan application.

An overview of how tax liens affect FHA loan eligibility

The impact of a tax lien on FHA loan eligibility depends on numerous factors, including the amount of the lien, the borrower's repayment history, and the steps taken to address the outstanding tax debt. In general, if a borrower has an unpaid tax lien, it may be necessary to satisfy the lien or establish a repayment plan acceptable to the IRS and the FHA before the loan application can be approved.

A borrower’s credit history is crucial to the FHA loan qualification process. And while a tax lien can negatively affect credit scores, the FHA provides some flexibility for borrowers who have made consistent payments towards the lien or have entered into a repayment plan. Demonstrating responsible financial management and a commitment to resolving the tax lien can improve your chances of obtaining an FHA loan.

Understanding the HUD tax lien guidelines is crucial to navigating the challenges tax liens present. These guidelines outline the steps borrowers must take to address outstanding tax liens, establish repayment plans, and demonstrate financial responsibility. By adhering to these guidelines, you are set to improve your chances of qualifying for an FHA home loan by far, taking you closer and closer to fulfilling your homeownership goals.

Steps to resolve tax liens and qualify for an FHA loan

When you have a tax lien, and you are looking to apply for an FHA loan, there are several steps that you can take to make it happen. They include the following;

- Understanding the FHA loan requirements – begin by familiarizing yourself with the basic requirements for an FHA loan, which include having a steady income, a good credit score (typically a minimum of 580), and a manageable debt-to-income ratio (typically below 43%). However, since the Federal Housing Administration insures FHA loans, they are popular among buyers who may have financial issues or lower credit scores, which makes it ideal for those who have a tax lien on their credit history. In addition to the mentioned requirements, you should have a valid Social Security number and be a lawful U.S. resident.

- Assess your tax lien situation – you then need to gather all the information relating to the tax lien, which includes the amount owed, the tax years involved, the taxing authority, and any other associated penalties. You should also ensure that you review any correspondence or notices you may have received from the taxing authority about the lien.

- Obtain your credit reports – the other thing you need to do is to obtain your credit reports from the credit bureaus, Equifax, Experian, and TransUnion, or you can also use a reputable credit monitoring service. Once you get the reports, carefully review them to identify any outstanding tax liens and ensure that everything reflected therein is accurate and up to date. Any inaccuracies must be disputed promptly, as failure to do so can negatively impact your credit score.

- Contact the taxing authority – you must also identify the taxing authority responsible for the tax lien. It could be the Internal Revenue Service, the State Department of Revenue, or the local tax authority. Then contact them to enquire about the tax lien. Ensure you provide all your details, including your full name, social security number, and any reference numbers associated with the lien. You must also request specific information about the tax lien, including the amount owed, payment options, and additional charges, to confirm whether it is correct.

- Negotiate a payment plan – also, when you contact the taxing authority, you should consider discussing or expressing your willingness to resolve the tax lien by inquiring about setting up a payment plan with the taxing authority. Ensure you provide them with an honest assessment of your financial situation and then propose a monthly payment amount you can afford. Also, since the taxing authority might ask you to produce supporting documentation, including income or bank statements, you must be prepared to produce them. Essentially, the goal is to negotiate a payment plan that would be acceptable to both parties.

- Start making payments – After agreeing on a payment plan, start making the payment as outlined in the agreement, which is on time and agreed upon – either by check, online payment, or money order. After making these payments, make sure that you keep records of the payments, including the date, amount, and payment method.

- Request for a payment agreement confirmation – you also need evidence for the payment agreement, so you should ask the taxing authority to provide written confirmation. This document includes details, such as the total amount owed, the agreed-upon payment schedule, and any specific conditions or requirements to satisfy the tax lien. Once you receive the document, file it with the other records, as you will need it when applying for the FHA loan.

- Fulfill the payment agreement – remember that once you commit to a payment agreement, you must continuously make payments according to the agreed-upon plan until the tax lien is fully satisfied. You should not violate the terms of the agreement, including the payment amount and schedule, no matter what. Otherwise, you will ruin the entire plan.

- Obtain a release of the tax lien – if you fully satisfy the lien, you can now request a release or discharge from the taxing authority. Typically, you will be provided with specific documents, which you will be required to complete and then submit to them, along with any supporting documentation that may be required. After that, your request will be reviewed, and if everything is in order, they will issue a release of the lien. Remember also to keep this document safe.

- Work on rebuilding your credit – while resolving your credit, you also need to improve your overall credit profile to increase your chances of loan approval. First, make sure you make all your payments on time, including your monthly utility bills, rent, and other debts. You can even set automatic payment reminders to ensure you never miss a payment.

- Reduce your debt-to-income ratio – reduce your debt-to-income ratio, which measures your ability to make monthly mortgage payments. Essentially, the DTI ratio assesses your monthly income against your monthly expenses to determine the amount remaining after fulfilling all your monthly bills. Therefore, consider paying down your existing debts or consolidating them if necessary. You can also consider increasing your income. Thirdly, avoid opening new lines of credit, taking on additional debt, or closing existing accounts; doing this will immediately impact your credit score. Fourthly, you can also consider other strategies to boost your credit score, such as keeping credit card balances low, maintaining a healthy credit utilization ratio, and avoiding negative credit activity.

- Apply for an FHA loan – once you’ve resolved your tax lien or have shown a real intent to resolve it by agreeing and following a repayment plan, and after working on your credit profile, you can now submit your FHA loan application to your lender. Contact an FHA-approved lender and provide them with all the necessary documentation, including the documents related to the tax resolution, proof of income, employment history, and bank statements.

The lender will then examine your application and all the documents you provided to determine your creditworthiness. If approved, you can proceed with the loan application process and work with the lender to finalize the loan terms and complete the necessary paperwork. Remember that steps in this process may vary depending on the specific circumstances, taxing authority, and FHA lender requirements. Therefore, you may want to research and consult the relevant experts for further guidance.

Additional considerations

You must remember a few important considerations even as you move to rectify your financial situation. Some considerations include the potential Impacts of unresolved tax liens on loan terms. First, as you may know by now, unresolved tax liens can significantly impact your ability to secure favorable loan terms for an FHA loan. Lenders consider tax liens a potential risk because they grant the taxing authority a legal claim on your property, affecting the lender’s collateral position. Consequently, unresolved tax liens can result in;

- Higher interest rates – lenders charge higher rates to compensate for the increased risk of unresolved tax liens.

- Limited loan amounts – the amount you can qualify for can be limited due to the potential encumbrance of the tax lien on the property’s value.

- Additional requirements – when it comes to the requirements, the lender may impose additional conditions or stricter underwriting standards to mitigate the tax lien’s risks.

- Longer approval process – unresolved tax liens can lead to a lengthier loan approval process as lenders conduct thorough evaluations and risk assessments.

Importance of consulting with professionals

The other thing you need to consider is how helpful it can be to seek help from qualified professionals in the field. The thing is, given the complexity of tax liens and their implications for FHA loan eligibility, it is recommended that you seek guidance from professionals in two key areas:

- Tax professionals – consulting with a tax expert, such as a CPA (certified public accountant) or tax attorney, can provide valuable insights into your tax situation. They can help you navigate the complexities of tax liens, negotiate with the taxing authority, and ensure you comply with all tax-related obligations.

- HUD-approved Housing Counsellors – these are trained professionals who provide guidance and support to individuals seeking homeownership opportunities. They can help you understand the requirements and implications of FHA loans, assist in developing a plan to resolve tax liens and provide personalized advice tailored to your circumstances.

Time frame to meet FHA loan eligibility after resolving tax liens

The last consideration you must remember is the time frame required after resolving the tax lien and before you can be eligible for the FHA loan. Now, the time frame required varies depending on the following factors;

- Resolution documentation – first, obtaining the release or discharge of the tax lien from the taxing authority is essential. The timing for receiving this documentation can vary, but initiating the process promptly after fulfilling the payment agreement is crucial.

- Reporting to credit bureaus – once the tax lien is resolved and released, it may take some time for the credit bureaus to update your credit reports. This process can take several weeks or even months – more specifically, 30 to 45 days.

- Credit score improvement – always remember that resolving a tax lien and making consistent on-time payments will positively impact your credit score. However, it takes time! The improvements are not immediate, so they may require several months of responsible financial behavior before you can see the results.

- Lender evaluation and loan approval – after meeting FHA loan requirements and resolving the tax lien, you will need to undergo the lender’s evaluation process. The length of this process may vary depending on factors such as the lender’s workload, your specific financial situation, and any additional requirements resulting from the tax lien.

Understanding hUD Tax lien guidelines To Get Approved for FHA Loans

Understanding the HUD tax lien guidelines is crucial for anyone looking to qualify for an FHA home loan. These guidelines are not meant to protect the lender’s interests and ensure that potential borrowers are financially stable and capable of repaying their mortgage obligations. They clarify the steps you are supposed to follow to resolve any outstanding tax liens before applying for an FHA loan. Remember that these loans offer numerous advantages, including flexible credit requirements, which make homeownership accessible to more individuals. And by aligning with the HUD tax lien guidelines, you can overcome obstacles and access an affordable financing option. Lastly, we must insist on consulting with qualified professionals in the field. Remember that these are individuals with so much knowledge in this field, so they can provide guidance that is tailored to your specific circumstances. This expert assistance can ensure a smoother path to homeownership while avoiding potential pitfalls related to tax liens.