This guide covers qualifying for a traditional and non-traditional jumbo mortgage at Mortgage Lenders for Bad Credit, a wholly-owned subsidiary of Gustan Cho Associates. A conforming mortgage loan is any residential mortgage loan that conforms to Fannie Mae and Freddie Mac mortgage guidelines. Both Fannie Mae and Freddie Mac have a maximum mortgage lending limit of $832,750 unless the property is in a high-cost area. Any loan limit higher than $832,750 are called non-conforming loans or Jumbo Mortgage.

Qualifying For A Jumbo Mortgage with no income tax returns is possible with our non-traditional jumbo loan or non-QM jumbo mortgage for self-employed borrowers.

Mortgage lenders for bad credit will use alternative income sources on non-QM jumbo mortgage such as bank statement deposits, DSCR, asset depletion, or other alternative means. 12 or 24 months of bank statement deposits are averaged and that monthly average is used as borrowers monthly income on non-QM jumbo mortgage. 10% to 20% down payment is required. The down payment requirement depends on borrowers credit scores and debt-to-income ratios.

Understanding Traditional vs Non-QM Jumbo Mortgage Loans

Jumbo Mortgages in 2026: Compare traditional and Non-QM jumbo loans, including requirements, rates, down payments, reserves, documentation, and how quickly you can qualify.

Explore the differences between Traditional and non-QM jumbo mortgage loans. Learn eligibility requirements, down payment options, and how to secure financing for luxury properties exceeding conforming loan limits.

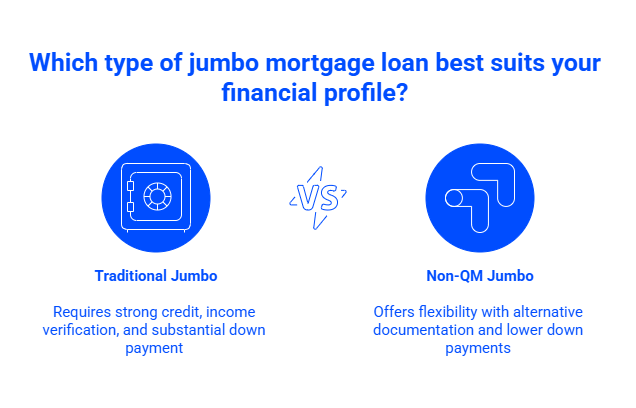

In this blog, we will do a comparison of non-QM mortgages for self-employed borrowers versus traditional jumbo mortgage. One major difference in qualifying for non-QM jumbo mortgage for self-employed borrowers is that traditional jumbo lenders require 700 credit scores where non-QM lenders only require 620 credit scores.

Need a Jumbo Loan but Don’t Fit the Bank Box?

Call Gustan Cho Associates at 800-900-8569 and let us compare traditional and non-QM jumbo mortgage loans for your scenario

Introduction: What is a Jumbo Mortgage

A jumbo mortgage, also known as a jumbo loan, is a loan amount that exceeds the conforming loan limit. Because of this, it cannot be sold to Fannie Mae or Freddie Mac and must follow the lender’s own guidelines. The CFPB is the government regulatory agency that oversees non-QM and Qualified Mortgages.

Because jumbo loans are for larger amounts, underwriters look closely at your credit, reserves, income, and property type. Today, jumbo financing is available to more than just the “ideal borrower.”

You can apply for a traditional jumbo loan, which requires full documentation and strong credit, or a Non-QM jumbo loan, which allows more flexible documents and alternative ways to qualify. A jumbo mortgage loan is a specialized financing option designed for home purchases that exceed the conforming loan limits set by Fannie Mae and Freddie Mac. In 2025, most areas have a conforming limit of $832,750, but high-cost markets may allow loans up to $1,249,125. When your dream home’s price tag surpasses these thresholds, you’ll need jumbo financing.

What Are Jumbo Mortgage

Any mortgage loan that exceeds the conforming loan limit of $832,750 are called a non-conforming loan or Jumbo mortgage:

- A Jumbo Home Mortgage loan exceeds the conforming lending limit set by Fannie Mae and Freddie Mac.

- Fannie Mae and Freddie Mac purchases mortgages originated by lenders in the United States.

- In order for them to purchase loans from private lenders, the mortgage loans need to conform to their lending guidelines.

Jumbo loans cater to luxury homebuyers, investors purchasing high-value properties, and borrowers in competitive real estate markets where prices naturally exceed standard limits. Unlike conventional mortgages, jumbo loans require more stringent qualification criteria and offer both traditional and non-qualified mortgage (Non-QM) options to accommodate diverse financial profiles.

Qualifying For Jumbo Mortgages And Its Requirements

Jumbo lending requirements depend on the individual

- Jumbo lenders generally have stricter eligibility requirements and are much tougher to qualify than any other mortgage loan programs

- Jumbo lenders normally require the following

- much higher credit scores

- higher down payment requirements

- lower debt-to-income ratio

- reserve requirement

- often have higher closing costs and higher interest rates than conventional loan programs

How Lenders View Risk On Borrowers Qualifying For Jumbo Mortgages

Jumbo Mortgages are considered high risk.

- Jumbo Mortgages are loans on higher-end homes

- If a Jumbo home lender defaults on their Jumbo Mortgages, it may take some time for the lender to liquidate the property

- Higher end homes generally take longer to sell

- This is the case since they are normally custom homes than tract homes

Risk Versus Rewards Of Traditional Jumbo Lenders

Jumbo Lenders need to offset this risk by counting that they have a strong borrower with a good payment history and higher credit scores and high income.

- High credit scores and strong payment history proves that the borrower is financially responsible.

- High income and job longevity proves that the borrower will not have any problems in paying his or her Jumbo Mortgage payments in the future.

- Jumbo Mortgage lenders are not real estate investors.

- They do not want the high-end property.

- They just want Borrowers to make good on their Jumbo mortgage loan payments.

- Jumbo Mortgage Lenders normally require a minimum credit score of 700.

- Debt-to-income ratio of 45% is normally required by a traditional jumbo lender.

- However, many lenders of jumbo mortgages can go up to 50% debt-to-income ratios.

- Higher credit scores, higher down payments, and lower debt-to-income ratios make lenders of jumbo mortgages feel secure on borrowers making payments without any strain every month.

What Is a Jumbo Mortgage Loan and When Do You Need One?

Traditional Jumbo Mortgages: The Gold Standard for High-Value Financing

Understanding Qualified Mortgage (QM) Requirements for Jumbo Loans

Traditional jumbo mortgages fall under the Qualified Mortgage (QM) category, meaning they meet specific consumer protection standards established by the Consumer Financial Protection Bureau (CFPB). These loans require thorough documentation of income, assets, and employment history, typically spanning the last two years.

Borrowers must demonstrate strong credit scores (usually 700+), substantial reserves (often 6-12 months of mortgage payments), and debt-to-income ratios below 43%. The underwriting process is more rigorous than that of conventional loans, as lenders assume increased risk with these larger loan amounts that aren’t backed by government-sponsored enterprises.

Credit Score Requirements for Traditional Jumbo Financing

Most traditional jumbo lenders expect a minimum credit score of 700-720, although premium pricing may require a score of 740 or higher for the best rates. Your credit history must show responsible payment patterns, low credit utilization ratios, and no recent bankruptcies or foreclosures. Higher loan amounts may necessitate even stronger credit profiles.

Down Payment Expectations for Conventional Jumbo Loans

Traditional jumbo mortgages typically require larger down payments than conventional loans, often ranging from 10-20% of the purchase price. Some lenders may accept as little as 5% down for exceptionally qualified borrowers, but expect more stringent requirements across the board. Larger down payments demonstrate financial stability and reduce lender risk.

Income Verification and Documentation Standards

Expect comprehensive income verification including recent pay stubs, W-2 forms, federal tax returns (personal and business), and bank statements. Self-employed borrowers must provide additional documentation such as profit/loss statements and business tax returns. Consistent income history is crucial for traditional jumbo approval.

High-Price Home Buyer With Complex Income?

Reach out today and we’ll show you the difference between traditional jumbo guidelines and non-QM jumbo loan programs

Non-QM Jumbo Loans: Flexible

Qualifying For A Jumbo Loans With Late Payments

Non-QM jumbo loans serve borrowers who don’t meet traditional qualification standards but have strong financial profiles nonetheless. These include self-employed professionals, real estate investors, entrepreneurs with variable income, foreign nationals, and individuals who have experienced recent credit events but have since rebounded financially. Jumbo lenders frown on late payments and most lenders with want to see timely payments in the past 24 months.

- Lenders of traditional Jumbo mortgages normally frown on gaps in employment.

- They want to see borrowers has been in the same job for the past 24 months.

- They also want to see borrowers in the same line of work for the past 4 years or more.

- Prior bankruptcy and foreclosure is normally frowned upon.

- Most lenders of jumbo mortgages will not lend to anyone who had a bankruptcy or foreclosure in the past 7 years and some will go as far back as 10 years.

Non-QM Jumbo Lenders are totally different. There is no waiting period after housing event and/or bankruptcy. Late payments are allowed. Credit Scores down to 620. Debt-to-income ratios up to 50% DTI with compensating factors.

Down Payment Requirements on Jumbo Mortgages

Most lenders of traditional jumbo mortgages require a minimum of 20% down payment on a home purchase.

- To get the best available mortgage rates on jumbo mortgages, borrowers should plan on having a 25% down payment and a 740 credit score with a maximum debt-to-income ratio of 45%

- Lenders of jumbo mortgages also want to see borrowers with at least a one-year cash reserve that covers principal, interest, taxes, and insurance and a strong financial statement

- Non-QM Jumbo Mortgage Lenders require 10% to 20% down payment

- Down payment requirement depends on borrowers credit scores

Qualifying For Jumbo Mortgages: Types Of Jumbo Mortgages

Jumbo mortgages are mainly for primary owner-occupant homes. However, you can have jumbo mortgages on second homes and investment properties.

- There are portfolio lenders of Jumbo mortgages that will do second home Jumbo mortgages.

Borrowers need to have extreme strong financials which consist of the following:

- High credit scores

- Strong income

- Strong assets

- Reserves

- Strong solid compensating factors

Asset-Based Jumbo Loans Without Income Verification

Asset depletion loans allow qualified borrowers to qualify based on liquid assets rather than traditional income documentation. Lenders calculate a monthly income based on your total qualifying assets divided by a set number of months (typically 360). This option works well for retirees, those living off investments, or business owners with irregular cash flow.

Bank Statement Jumbo Loans for Self-Employed Borrowers

Self-employed individuals can qualify using 12-24 months of personal or business bank statements instead of tax returns. Lenders analyze average monthly deposits to calculate qualifying income, making this ideal for entrepreneurs, freelancers, and small business owners who minimize taxable income through deductions.

Interest-Only Jumbo Mortgage Options for Cash Flow Management

Interest-only jumbo mortgages enable borrowers to pay only the interest portion for an initial period (typically 5-10 years), thereby significantly reducing their monthly payments. This suits professionals expecting income growth, investors planning to sell before principal payments begin, or those with variable commission-based incomes.

Foreign National Jumbo Loan Programs

Non-citizen borrowers without U.S. credit history can access jumbo financing through specialized foreign national programs. These loans consider international credit reports, larger down payments (typically 20-30%), and may require ITIN numbers instead of Social Security numbers.

10% Down Payment, 90% Loan To Value, No Mortgage Insurance Jumbo Mortgages

The team at Mortgage Lenders for Bad Credit can offer qualified high-end home buyers a special 10% down payment, 90% loan to value, with no mortgage insurance NON-QM Jumbo mortgages for self-employed borrowers:

- However, the borrower needs to be a strong borrower with compensating factors.

- Minimum credit score required is 620.

- Maximum debt to income ratio needs to be no greater than 50%.

- Interest rates on the 10% down payment Jumbo mortgage loan program is slightly higher than the 20% down payment.

- No private mortgage insurance required.

- No income tax returns required.

Jumbo Mortgage Loan Limits for 2026: What makes a Loan “Jumbo”?

A loan is considered “jumbo” when it exceeds the FHFA conforming loan limit for the mortgage type in your specific county.

FHFA made the following announcements for 2026:

- Baseline conforming limit (most U.S. counties): $832,750 (1-unit)

- High-cost area ceiling: $1,249,125 (1-unit)

- Special statutory areas (Alaska, Hawaii, Guam, U.S. Virgin Islands): baseline and ceiling are higher (FHFA.gov)

Since loan limits vary by county, two people buying homes at the same price could have different loan options. One might qualify for a conforming or high-balance loan, while the other needs a jumbo mortgage. That’s why borrowers should understand the details of both traditional and Non-QM jumbo loans.

Comparing Interest Rates: Traditional vs. Non-QM Jumbo Mortgages

How Jumbo Mortgage Rates Differ from Conventional Loans

Jumbo mortgage rates typically run 0.125% to 0.5% higher than comparable conventional loans due to increased lender risk and lack of government backing. However, in some market conditions, jumbo rates may actually be lower than conventional rates as lenders compete for high-value clients.

Rate Variations Between Traditional and Non-QM Jumbo Products

Non-QM jumbo loans generally carry higher interest rates than traditional jumbos, typically 0.5% to 2% higher, depending on program type and borrower risk profile. The most significant rate differences appear in bank statements and asset depletion programs, while interest-only options may have rates closer to traditional jumbos.

Factors Influencing Your Jumbo Mortgage Rate

Your credit score, down payment amount, loan size, property type, and cash reserves all impact your jumbo rate. Larger loans often receive better pricing due to economies of scale, while investment properties and second homes typically carry higher rates than primary residences.

Traditional Jumbo Mortgage Loans: Full-Doc Jumbo Financing for Prime Borrowers

A traditional jumbo mortgage means:

- Full documentation (W-2s, paystubs, tax returns if required).

- Good credit score (generally above 700).

- Verified assets and reserves.

- Conservative debt-to-income (DTI) ratios compared with conforming loans.

- Jumbo loans are often used for high-net-worth individuals (clients with >$1M net worth).

- High-earning W-2 employees.

- High self-employed individuals with strong tax return income.

- Buyers with high liquid net worth.

- Secondary homes and some investment property scenarios (varies by lender).

Requirements on Traditional Jumbo Mortgage (Typical, Not Universal)

Each lender has its own underwriting parameters, but traditional jumbo entails:

History on credit and payments

- Conforming mortgage/rent and credit score expectations are higher (more than 50% of the time)

- Positive mortgage/rent history

Down payment

- 10%-23% of the loan on average (varies by underlying loan amount, property type, occupancy, borrower credit score, etc.)

DTI and cash-flow

- Conforming loans have more aggressive DTI and cash-flow guidelines than low DTI jumbo loans do.

- Large balance loans are less concerned with DTI if the cash-flow metric is positive.

Denied for a Jumbo Loan at the Bank? Don’t Stop There

Call 800-900-8569 and let us re-underwrite your file using common-sense traditional and non-QM jumbo mortgage guidelines

Cash reserves

Jumbo lenders often require cash reserves (or eligible assets) for after-closing months, especially:

- Higher loan dollar amounts.

- Borrowers with multiple properties.

- Self-employed borrowers.

- Secondary homes/investment property borrowers.

- Traditional Jumbo Mortgage Rates: Fixed vs ARM.

Jumbo borrowers usually consider:

- 30-year fixed jumbo for long-term stability.

ARM jumbo options (5/6, 7/6, 10/6, etc.) when:

- They anticipate selling or refinancing before the fixed period ends.

- They desire a lower initial payment.

- They’re using the jumbo strategically for cash flow management.

Rate pricing is dependent on:

- Loan size and LTV.

- Credit score and depth of the profile.

- Type of property (primary, secondary, or investment property).

- Strength of reserves and/or assets.

- Current state of the market.

Non-QM Jumbo Mortgage Loans:

Jumbo Financing and Non-QM jumbo mortgages are designed for borrowers who don’t meet standard underwriting rules, often because their income documentation is limited or unusual, or their financial situation is more complex. plex financial circumstances. A Non-QM loan doesn’t meet strict “qualified mortgage” or agency rules. Instead, it follows investor guidelines and allows non-traditional documentation to demonstrate your ability to repay the loan. Non-QM is not the same as “subprime” or “no verification.” It simply gives you different ways to prove your income and qualify when standard rules don’t fit.

Non-QM Jumbo Loans Target Market

- Self-Employed Borrowers with heavy write-offs.

- 1099 workers and freelancers.

- People with variable income, such as commissions and bonuses.

- High-net-worth individuals using asset-based qualification.

- Investors with DSCR jumbo (cash-flow-based) loans.

- Interest-only jumbo loans for better cash flow management.

- People with recent credit events (Program Dependent)

Long-Tail Analysis of Non-QM Jumbo Mortgage Loans

- Bank Jumbo Statement Mortgage Loans for Self-Employed Borrowers: bank statement jumbo mortgage uses 12 or 24 months of your personal or business bank statements to figure out your qualifying income, instead of relying on tax returns.

- This can give a clearer picture of your cash flow, especially if your tax returns only show net income after deductions.

Things to verify a business:

- 12–24* months of bank statements.

- A letter from a CPA or business verification (required by some programs).

- Some of these programs apply an expense factor to business deposits.

Asset Depletion Jumbo Loans for High-Net-Worth Buyers

Asset depletion jumbo mortgages allow buyers to convert their qualifying assets into an income stream. This is especially helpful for retirees, individuals transitioning between executive roles, or anyone whose wealth is primarily invested.

Assets that can be considered (may vary by program):

- Cash assets (checking/savings).

- Brokerage accounts.

- Retirement accounts (with modifications).

- Other certified assets that qualify.

DSCR Jumbo Loans for Real Estate Investors

A DSCR jumbo loan is based on the property’s cash flow, measured by the Debt Service Coverage Ratio. This often means you don’t need to provide as much personal income documentation.

Ideal for:

- Investors increasing the number of holdings in their portfolio.

- Borrowers looking to avoid income documentation.

- The property has an in-place market rent.

Interest-Only Jumbo Loans for Flexible Payments

An interest-only jumbo mortgage gives you lower payments for a set period when you pay only the interest. This can help with cash flow. It’s often used by:

- Professionals with high but uneven income (bonuses).

- Business owners with cash in the business and operation.

- Note: Remember that your payments will change after the interest-only period ends.

- Some programs also offer jumbo loans to foreign nationals, not just U.S. citizens and residents.rams are also available for foreign nationals seeking jumbo loans.

Foreign National Jumbo Mortgage Loans (Select Programs)

Certain Non-QM investors offer jumbo financing specifically for foreign nationals, usually highlighting:

- Higher initial investment

- Solid fund source

- Alternate credit justification

- Program-specific Visa/residency requirements

Traditional Jumbo vs Non-QM Jumbo Loans: How to Choose the Right Jumbo Mortgage

Select traditional jumbo when:

- Your tax returns backed the income you needed

- You were looking for the most competitive pricing for your profile.

- You possessed good credit, sufficient reserves, and consistent employment/income.

Select Non-QM jumbo when:

- You are self-employed with significant write-offs.

- Your income is indeed “there,” but it “doesn’t underwrite well” conventionally.

- You prefer a different qualification approach (bank statements, DSCR, asset depletion).

- You require a specialized option (interest-only, recent credit event flexibility).

The best strategy is usually to price and underwrite both tracks, traditional jumbo and Non-QM jumbo, and select the option that provides the best mix of approval certainty, monthly payment, and overall cost. Once you decide, the next step is to understand underwriting and what lenders prioritize for jumbo mortgages.

Jumbo Mortgage Underwriting: What Lenders Take a Closer Look At

Whether you choose a traditional or Non-QM loan, jumbo underwriting is usually more detailed in several key areas.

Credit Depth and Risk Pattern (Not Just the Score)

Most underwriters care about:

- Recent late payments (especially when it comes to housing).

- Utilization and debt installment structures.

- Credit history length and depth.

- Major derogatory events and the time since they occurred.

Reserves, Post-Closing Assets, and Liquidity

Jumbo lenders want to make sure you can handle:

- Payment shocks (adjustments of tax/insurance, payments on ARMs that are adjustable-rate).

- Volatility of the market (for borrowers that are asset-heavy).

- Surprise expenditures (larger homes create this more often).

Marketability and Appraisal of the Property

Jumbo properties can be more complex to value, so lenders may need:

- Knowledge of local high-end appraisers.

- Stronger common sales support.

- More extra review steps (field review or desk review).

See How Much Luxury Home You Can Afford With a Jumbo Loan

Apply online 24/7 with Gustan Cho Associates and get a personalized pre-approval for traditional and non-QM jumbo mortgage loans

Jumbo Mortgage Documentation Checklist (Traditional + Non-QM)

Here’s a practical checklist you can use to get ready as a borrower.

Standard Jumbo Mortgage Documents (Most Borrowers)

- Government-issued photo ID.

- 2 years of address history.

- Last 2 months bank statements (all pages).

- Last 2 months asset statements (brokerage/retirement, if applicable).

- Homeowners insurance quote (if applicable).

- Purchase contract (if applicable).

- Mortgage statement + taxes/insurance (if refinancing).

- Explanation letter for any recent credit inquiries or unique deposits (if applicable).

Income Documents for Traditional Jumbo Loans

- W-2s (last 2 years).

- Pay stubs (last 30 days).

- Tax returns (if applicable, last 2 years).

- Bonus/commission doc (if it was used to qualify).

- Self employed: business returns + K-1s + year to date P&L (if it was required).

Income Documents for Non-QM Jumbo Loans (Program Specific)

- Bank statements (12-24 months) for bank statement programs.

- CPA letter and/or business verification.

- Statement of assets (for asset depletion qualification).

- Lease agreement + proof of rent (for DSCR programs).

- Letters of explanation for credit events (if applicable).

“How We Know” and Our Jumbo Mortgage Process

Qualifying for a jumbo mortgage is more than just getting a pre-approval letter. It’s about finding the right jumbo program, gathering the right documents, and making a plan to get your loan approved. Our process focuses on three key aspects: first, determining whether a traditional or Non-QM jumbo loan is the best fit for you; second, verifying your income and assets promptly; and third, handling appraisals and reserve requirements upfront to prevent delays in underwriting.

Who is this Jumbo Mortgage Guide For?

The guide provides the most benefit to the following guide, which is especially helpful for customers who might exceed conforming limits.

- Move-up buyers who want to keep more cash while qualifying for the next tier.

- Self-employed borrowers whose tax returns don’t show the real cash flow they have.

- Real estate investors applying the DSCR jumbo strategy.

- Realtors and buyers relocating to new areas need a clear roadmap for jumbo loans in competitive markets.

FAQs: Traditional and Non-QM Jumbo Mortgage Loans

What is a jumbo mortgage loan?

- A jumbo mortgage is a type of mortgage loan that does not fit the guidelines of Fannie Mae and Freddie Mac, thus making it ineligible for the secondary mortgage market.

What is the conforming loan limit for 2026?

- For the year 2026, the cross-country baseline for conforming mortgage loans is $ 832,750.

- This is subject to change for high-cost regions and specified high-cost areas as per the guidelines set out by the FHFA.

Are jumbo mortgage rates higher than conventional loans?

- Normally, they would be, but not in all cases.

- A multitude of factors will determine jumbo loans and how they are priced, including the borrower’s credit, the loan-to-value ratio (LTV), and the amount of cash reserves the borrower has.

- As for the market, jumbo loans can be just as reasonably priced as any other conventional loans.

Is a high-balance loan the same as a jumbo loan?

- Not always. High-balance loans can still be conforming loans as long as they stay within the county’s high-cost conforming limit.

- Meanwhile, a jumbo loan always exceeds the conforming limit.

What credit score is needed for a jumbo mortgage?

- This will always depend on the specific lender and the specific loan program.

- In general, traditional jumbo loans tend to require higher credit scores, while Non-QM jumbo loans may be relatively more lenient and allow credit score deviations in conjunction with other compensating factors, such as a higher down payment or larger reserves.

What is the typical down payment for jumbo loans?

- This will depend on the lender, loan amount, and occupancy type.

- Generally speaking, for jumbo loans, down payment expectations tend to be in the 10%-20%+ range.

- However, some borrowers can even pay a lower down payment, or in rare cases, a higher down payment, especially when other compensating factors in the scenario are strong.

What are reserves for jumbo loans?

- This refers to the funds remaining after closing.

- These funds are typically measured in terms of months of mortgage payment to show the lender that you will be able to manage the payment.

Can a self-employed person get a jumbo loan?

- Self-employed jumbo loans are often possible.

- You may qualify for the traditional jumbo if your tax returns support it.

- For the Non-QM jumbo, you can qualify using bank statements, asset depletion, or other alternative documentation.

What is a Non-QM jumbo mortgage?

- A Non-QM jumbo loan is a type of jumbo loan that employs alternative qualification methods or does not conform to standard QM/agency definitions—often beneficial to self-employed borrowers, investors, or those with atypical income situations.

Can investors obtain jumbo loans without tax return documents?

- In many instances, yes—DSCR jumbo loans can qualify based on the property’s rental cash flow without requiring income documentation.

Do jumbo loans normally take longer to close?

- They may be due to more intensive underwriting and appraisal review, but timelines vary based on document preparation and lender procedures.

Is it more challenging to refinance a jumbo loan?

- Not necessarily, but refinancing is based on future rates, your equity, income/asset documentation, and whether you refinance into conforming/high-balance loans or stay jumbo.

Upgrade to a Luxury Home With the Right Jumbo Strategy

Contact Gustan Cho Associates to get a side-by-side quote on traditional versus non-QM jumbo mortgage options

The Jumbo Mortgage Application Process: What to Expect

Documentation Checklist for Jumbo Mortgage Approval

Prepare extensive documentation, including: two years of federal tax returns (all schedules), recent pay stubs (30 days), W-2 forms, two months of bank statements (all pages), investment account statements, gift letters (if applicable), and detailed asset documentation. For self-employed borrowers, include profit/loss statements and business tax returns.

Property Requirements for Jumbo Financing

Jumbo loans have stricter property appraisal standards, often requiring multiple appraisals for loans over $1 million. The property must be in good condition with no significant health or safety issues. Unique properties, log homes, or rural residences may face additional scrutiny or higher down payment requirements.

Timeline Differences in Jumbo Mortgage Underwriting

Expect a longer underwriting process for jumbo loans—typically 45-60 days compared to 30-45 days for conventional mortgages. The increased documentation requirements, additional appraisal needs, and manual review processes extend timelines, especially for complex Non-QM scenarios.

Advantages and Disadvantages of Jumbo Mortgage Financing

Benefits of Choosing Jumbo Over Combination Loans

Jumbo mortgages offer single-loan convenience versus first-and-second mortgage combinations, often with better overall rates. They provide more flexibility in property type and use, avoid second mortgage balloon payments, and typically feature more stable terms than piggyback loan structures.

Potential Drawbacks to Consider Before Committing

Jumbo mortgages require stronger financial profiles, larger down payments, and more extensive documentation. They’re less forgiving of credit issues, have fewer refinance options, and may feature prepayment penalties. Market conditions can also make jumbo loans harder to obtain during economic uncertainty.

Strategies for Securing the Best Jumbo Mortgage Terms

Improving Your Jumbo Mortgage Approval Odds

Boost your approval chances by: maximizing credit scores (pay down balances, dispute errors), accumulating substantial cash reserves, maintaining stable employment history, minimizing new debt applications before applying, and considering larger down payments to reduce lender risk.

Shopping Multiple Jumbo Mortgage Lenders Effectively

Compare at least three jumbo lenders, looking beyond rates to include: origination fees, underwriting timelines, rate lock options, prepayment penalties, and customer service reputation. Consider both portfolio lenders and big banks, as they may offer different program flexibility.

Rate Lock Considerations for Jumbo Loans

Given longer closing timelines, discuss extended rate lock options (60-90 days) with potential lenders. Understand float-down provisions that allow rate improvements if market conditions improve, and clarify any associated costs for longer lock periods.

Frequently Asked Questions About Jumbo Mortgage Loans

What is the minimum down payment for a jumbo mortgage?

- Traditional jumbo mortgages typically require 10-20% down, though some lenders may accept as little as 5% for exceptionally qualified borrowers.

- Non-QM jumbo loans often require 20-30% down, particularly for bank statement or foreign national programs.

Can I get a jumbo loan with less than perfect credit?

- While traditional jumbo loans usually require 700+ credit scores, some Non-QM programs may accept scores in the 600s with compensating factors like larger down payments, substantial reserves, or significant assets.

- Expect higher interest rates and stricter terms.

How long does it take to close a jumbo mortgage?

- Jumbo loans typically take 45-60 days to close, compared to 30-45 days for conventional mortgages.

- Complex Non-QM scenarios may extend timelines to 60-90 days due to additional documentation requirements and manual underwriting processes.

Are jumbo mortgage rates always higher than conventional rates?

- Not always. While jumbo rates typically run slightly higher than conventional loans, market conditions can sometimes make jumbo rates more competitive, especially for well-qualified borrowers seeking larger loan amounts.

What makes a jumbo mortgage “Non-QM”?

- Non-QM jumbo loans don’t meet the CFPB’s Ability-to-Repay standards, often due to alternative documentation methods like bank statements, asset depletion, or interest-only features.

- They serve borrowers with complex financial situations who don’t qualify under traditional guidelines.

Can I use a jumbo loan for an investment property?

- Yes, jumbo loans finance investment properties, but expect higher interest rates (typically 0.25-0.5%.

- High-end home buyers who need to qualify for non-QM jumbo mortgages for self-employed borrowers can contact us at Gustan Cho Associates at 800-900-8569 or text us for faster response.

- 10% to 20% down payment on purchase with no loan limit.

- There is no private mortgage insurance required.

- Minimum credit scores required is 620.

- Down payment requirement depends on borrowers credit scores.

- There is no waiting period after foreclosure, deed in lieu of foreclosure, short sale to qualify for non-QM jumbo mortgages.

- No income tax returns are required. We go off by the average of 24 months bank statement deposits.

Start Your Process Towards Buying A Home

Apply Now And Get recommendations From Loan Experts