MLO Revenue Share Residual Income Career Opportunity

This guide will cover the MLO revenue share residual income career opportunity at Mortgage Lenders For Bad Credit, powered by Gustan Cho Associates. Wendy Lahn, The Chief Legal Officer at Mortgage Lenders For Bad Credit, explains the benefits of the MLO Revenue Share Residual Income Career Opportunity at Mortgage Lenders For Bad Credit as follows:

With MLO Revenue Share Residual Income, loan officers can earn residual income from their clients’ ongoing business and referrals. Residual income is important in the mortgage industry because it provides MLOs with a stable and predictable income stream. Commission-based income can be volatile, depending on the number and size of loans originated.

The MLO Revenue Share Residual Incom opportunity is possible through partnerships with mortgage companies offering their loan officers revenue-sharing models. Mortgage loan officers are responsible for helping clients secure financing for their home purchases or refinancing needs. They typically earn commission-based income from the loans they originate.

MLO Revenue Share Residual Income Career Opportunity

The mortgage industry is an ever-evolving field that offers a range of career opportunities. One such opportunity is MLO Revenue Share Residual Income, which allows mortgage loan officers (MLOs) to earn residual income in addition to their regular commission-based income. This residual income is generated from clients’ ongoing business and referrals, providing MLOs with a stable and predictable income stream.

Excellent sales and marketing skills are crucial to succeeding in the MLO Revenue Share Residual Income career opportunity. This means having the ability to identify and prospect potential clients, build relationships, and close deals effectively.

In this article, we will explore the concept of MLO Revenue Share Residual Income as a career opportunity, including its benefits, requirements, tips for success, advantages, and risks. Whether you are a seasoned MLO or looking to start a career in the mortgage industry, this article will provide valuable insights into this unique career opportunity.

Introduction to MLO Revenue Share Residual Income Opportunity

MLO Revenue Share Residual Income is a unique career opportunity in the mortgage industry that allows MLOs to earn residual income in addition to their regular commission-based income. Residual income is earned from clients’ ongoing business and referrals, providing MLOs with a stable and predictable income stream.

The MLO Revenue Share Residual Income can provide financial security for MLOs, as it provides a steady stream of income in addition to their regular commission-based earnings.

Residual income, on the other hand, is generated from clients’ ongoing business and referrals, providing MLOs with a source of income even during slower periods. This can help MLOs better manage their finances and plan for the future. Additionally, residual income can help mortgage companies attract and retain talented loan officers by providing them with an additional source of income.

What is MLO Revenue Share Residual Income?

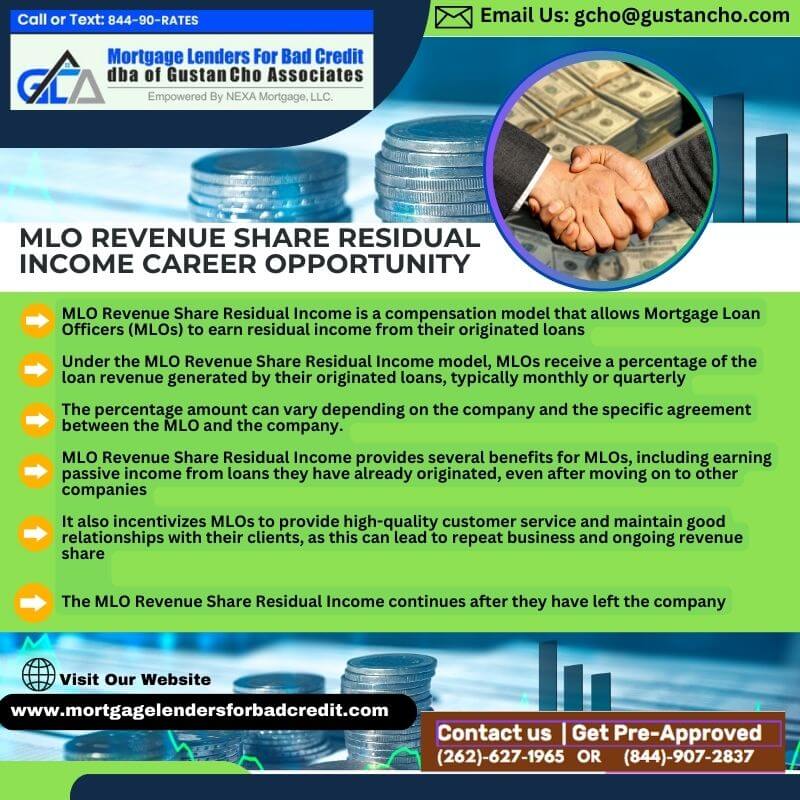

MLO Revenue Share Residual Income is a compensation model that allows Mortgage Loan Officers (MLOs) to earn residual income from their originated loans. The MLO Revenue Share Residual Income continues after they have left the company. Wendy Lahn of Mortgage Lenders For Bad Credit explains the MLO Revenue Share Residual Income Career Opportunity at Mortgage Lenders For Bad Credit;

In other words, MLOs continue to earn money based on their originated loans, even if they are no longer working for the same mortgage company. Under the MLO Revenue Share Residual Income model, MLOs receive a percentage of the loan revenue generated by their originated loans, typically monthly or quarterly. The percentage amount can vary depending on the company and the specific agreement between the MLO and the company.

MLO Revenue Share Residual Income provides several benefits for MLOs, including earning passive income from loans they have already originated, even after moving on to other companies. It also incentivizes MLOs to provide high-quality customer service and maintain good relationships with their clients, as this can lead to repeat business and ongoing revenue share.

Requirements for MLO Revenue Share Residual Income

To become a successful MLO revenue share residual income earner, there are some key requirements that you must meet. These requirements go beyond basic education and licensing, and they are essential to creating a strong foundation for a long and successful

a career in the mortgage industry.

Participating in mortgage industry conferences and networking events can also help to build relationships and improve sales and marketing skills. Furthermore, a willingness to learn and stay updated with the latest trends in the mortgage industry is essential to succeed in this career opportunity.

Many mortgage companies and brokerages require their MLOs to undergo regular training and continuing education to stay up-to-date on industry changes and regulations. This education can include mortgage lending laws, customer service, and sales and marketing techniques.

Sales and marketing skills

As an MLO, you’ll need to have excellent communication skills and the ability to communicate complex financial information clearly and concisely. Additionally, being tech-savvy and comfortable using digital tools to manage and track leads and deals is essential.

By obtaining the required licensing and education, you will gain the knowledge and skills to navigate the mortgage industry effectively and provide excellent service to your clients.

To acquire these skills, one can participate in training programs, workshops, and seminars focusing on developing effective sales and marketing strategies.

Understanding of mortgage industry regulations

To become an MLO and participate in a revenue share residual income career opportunity, it is important to have a strong understanding of mortgage industry regulations. This includes knowledge of federal and state laws and lender-specific policies and procedures.

Some key regulations to be familiar with include the Truth in Lending Act (TILA), the Real Estate Settlement Procedures Act (RESPA), the Home Mortgage Disclosure Act (HMDA), and the Fair Credit Reporting Act (FCRA).

MLOs must be able to navigate and comply with state-specific licensing requirements and regulations. Keeping up to date with changes in regulations and policies is critical to ensuring compliance and maintaining a successful career in the mortgage industry. MLOs can achieve this by attending training sessions and seminars and regularly reviewing updates from regulatory agencies and industry publications.

Tips for Success in MLO Revenue Share Residual Income

To succeed in MLO Revenue Share Residual Income, certain tips and strategies can help individuals build successful career. Here are some tips that can help MLOs achieve success in this field.

To become an MLO revenue share residual income earner, you must first meet the licensing and education requirements set by the National Mortgage Licensing System (NMLS). This involves completing the required pre-licensing education courses, passing the NMLS licensing exam, and meeting state-specific requirements for mortgage loan originators.

To succeed in MLO revenue share residual income, developing a strong network of industry professionals and potential clients is important. This can be achieved through networking events, social media platforms, and community involvement. It is also essential to

maintain and nurture these relationships by staying in touch with contacts and providing value to them.

Building a brand and marketing strategy

MLOs should develop a personal brand and marketing strategy to differentiate themselves in a competitive market. This may include creating a professional website, social media presence, and a consistent brand message across all marketing materials. MLOs should also stay up-to-date on the latest marketing trends and techniques to remain relevant and effective.

Providing excellent customer service is crucial for MLOs seeking a successful career in revenue share residual income. This includes being responsive, knowledgeable, and transparent with clients throughout the loan process. MLOs should also strive to exceed client expectations and provide a positive experience, which can lead to referrals and repeat business.

Advantages of MLO Revenue Share Residual Income

MLO Revenue Share Residual Income is a lucrative and rewarding career opportunity in the mortgage industry. This compensation structure allows MLOs to earn a share of the revenue generated by the loans they originate, providing a source of residual income. In addition to the potential for high income, there are many other advantages to pursuing a career in MLO Revenue Share Residual Income.

Potential for High income and Growth

One of the most significant advantages of MLO Revenue Share Residual Income is the potential for high income. As MLOs continue to build their client base and residual income stream, they can earn substantial money. In addition, the residual income earned from past loans can continue to generate income for MLOs even after moving on to new clients.

With dedication and hard work, MLO Revenue Share Residual Income can offer a rewarding and fulfilling career path in the mortgage industry.

MLO Revenue Share Residual Income offers opportunities for growth and advancement in the mortgage industry. Successful MLOs can move up the ranks to become team leaders and branch managers or even start their mortgage brokerage firms.

Risks and Challenges of MLO Revenue Share Residual Income

A career in MLO Revenue Share Residual Income can be rewarding, but like any career, it has challenges and risks. It is important for individuals considering this career path to be aware of these potential downsides before pursuing it further. Some of the risks and

challenges of MLO Revenue Share Residual Income. Wendy Lahn, Chief Legal Officer at Mortgage Lenders For Bad Credit, said the following:

MLOs are typically dependent on the performance of the mortgage company they work for. If the company experiences financial difficulties or a downturn in the housing market, it can negatively impact the MLO's income potential. MLOS needs to choose a reputable and financially stable company to work for to minimize this risk.

The mortgage industry is highly competitive, and MLOs must be able to differentiate themselves from other professionals in the industry. This can be challenging, particularly for those new to the industry or with limited experience.

Need for ongoing education and training

In conclusion, MLO Revenue Share Residual Income can provide a lucrative career opportunity for those interested in the mortgage industry. It offers the potential for high income, flexibility, and opportunities for growth and advancement.

It also comes with risks and challenges, such as dependence on company performance, competitive market conditions, and the need for ongoing education and training. To succeed in this career, it is important to meet the licensing and education requirements, develop strong sales and marketing skills, and provide excellent customer service.