Mortgage Denial After Approval By Underwriters

In this blog, we will cover getting a mortgage denial after approval by underwriters. After you get a mortgage denial after approval by a mortgage loan underwriter, what do you do? What are your next steps? Do you appeal with the same lender or take the mortgage loan request to a different one?

For prospective homeowners, securing a home loan can often feel like navigating a maze filled with excitement, anticipation, and even a hint of severe anxiety.

Ultimately, if a borrower’s financial situation undergoes significant changes between pre-approval and the final loan application, it can raise concerns for the lenders. Obtaining pre-approval from a mortgage lender is seen as a beacon of hope, assuring that the dream of homeownership is literary within reach.

What Is The Common Reason For Mortgage Denial After Approval

What happens when that long-awaited pre-approval becomes a crushing denial from the underwriters? Imagine, after being pre-approved, you went looking for property, thinking everything would fall into place, only to receive the bad news when you started the closing process.

The presence and severity of these discrepancies or missing details can raise red flags and result in a loan denial. So, borrowers must ensure that all information provided during pre-approval is accurate and complete. Changes in loan requirements or lender guidelines

The emotion that can follow would range from confusion to frustration, leaving you wondering how a seemingly solid mortgage application could crumble under the scrutiny of the underwriters. In this article, we will shed some light on this issue, which is perplexing, giving you some of the factors that contribute to this painful experience, plus the potential solutions on how to avoid it.

What is mortgage pre-approval?

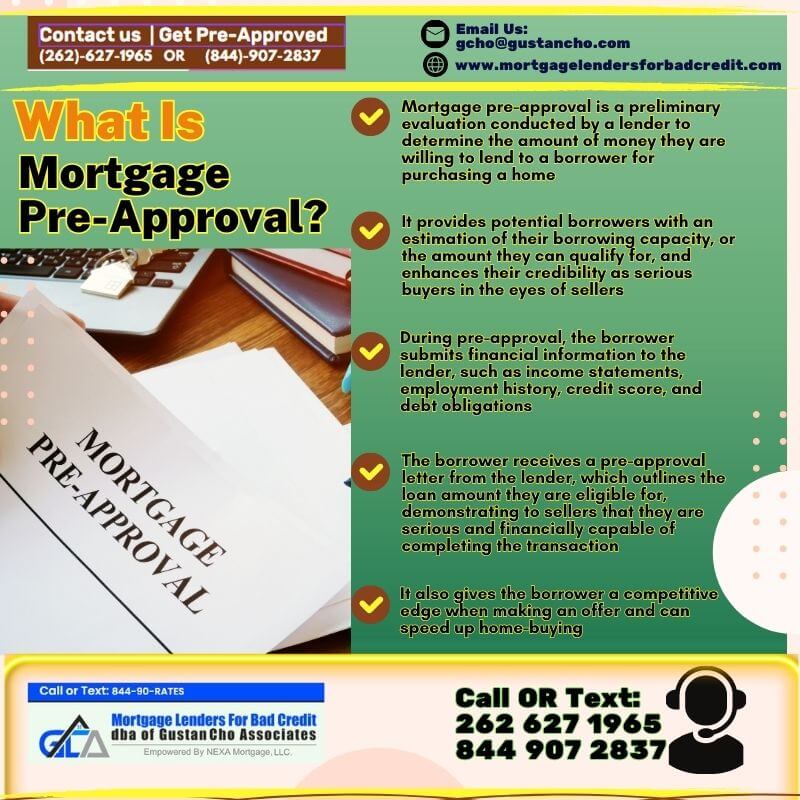

Before we understand why a mortgage could be denied after being pre-approved, it makes sense first to understand what mortgage pre-approval is. Mortgage pre-approval is a preliminary evaluation conducted by a lender to determine the amount of money they are willing to lend to a borrower for purchasing a home. It is a very important step in the home-buying process. It provides potential borrowers with an estimation of their borrowing capacity, or the amount they can qualify for, and enhances their credibility as serious buyers in the eyes of sellers.

During pre-approval, the borrower submits financial information to the lender, such as income statements, employment history, credit score, and debt obligations. The lender then carefully reviews this information to assess the borrower’s creditworthiness, loan repayment ability, and overall financial stability.

When a borrower gets pre-approved, the pre-approval carries more weight, especially when making an offer on a home. The borrower receives a pre-approval letter from the lender, which outlines the loan amount they are eligible for, demonstrating to sellers that they are serious and financially capable of completing the transaction. It also gives the borrower a competitive edge when making an offer and can speed up home-buying.

Is a Pre-Approval a Commitment to lend

You need to remember that a mortgage pre-approval is not a guarantee of loan approval, as it is just a preliminary assessment of your financial information.

With that said, the best way to avoid this is to ensure that you keep paying your bills on time without fail, even after the pre-approval, to maintain a clean credit report.

The final approval is contingent upon the lender’s thorough underwriting process, which occurs after the borrower has chosen a specific property and submitted a complete loan application. This is to say that a borrower can still be denied the loan, even after the pre-approval.

Reasons why you Get Mortgage Denial After approval

There are several reasons why a borrower may be denied a mortgage even after receiving a pre-approval letter. They include one of many reasons. One of the most common reasons for mortgage denial after pre-approval would be a change in your financial circumstances, especially your employment status.

For instance, a decrease in income due to a job loss or reduced work hours can affect a borrower’s ability to meet mortgage payments, which will certainly be a red flag to a lender. Similarly, adding additional or significantly increasing existing debt will negatively impact your debt-to-income ratio, making you appear riskier to lenders.

Some changes might be acceptable. Major changes are the ones that are largely frowned upon. The best solution for this would be to consult a financial expert about all possible changes that may come in the future and how to deal with them if they are to happen. Largely, the expert may be able to predict any such occurrence and would be able to advise you accordingly.

Mortgage Denial After Approval Due To Credit issues

For each mortgage available, there are specific credit score guidelines that one has to meet to be eligible. Now, if, for some reason, something happens that hurts your credit score during the pre-approval period and final closing, it is highly likely that your loan application will be denied. Remember, pre-approval typically involves an initial credit check.

Mortgage lenders evaluate the borrower’s credit history more comprehensively during underwriting. And if they notice any negative information on your credit history, that can be the reason for mortgage denial after pre-approval. Reason for mortgage denial after approval can be such as late payments, higher credit card balances, or collections.

Derogatory credit issues can indicate financial instability, resulting in a denial. In addition, the lender will also look for any derogatory items that may have appeared in your credit report after pre-approval, like bankruptcies, judgments, or foreclosures, which will also result in automatic disapproval.

Mortgage denial After Approval Due to Inaccurate information

As mentioned, the lender reviews your financial history to determine your creditworthiness during pre-approval. However, during the underwriting process, the lenders/underwriters thoroughly verify the information you provided, and they will most likely notice any discrepancies they initially missed.

Even after the pre-approval, it is possible for the loan product requirements or guidelines to experience changes. For instance, a lender may have initially required a credit score of 620 to approve a borrower but then changed the requirement to 640. This means it will lead to a mortgage denial if the lender retroactively applies this requirement.

Other potential changes that might lead to the mortgage denial include debt-to-income guideline changes or the amount of savings required. You can’t do much about this as changes largely influence it in economic conditions, lending regulations, or the lender’s risk appetite – aspects you can’t control! Just keep doing everything right to ensure that your financial health is much higher and that such changes wouldn’t affect you.

Property-related concerns

It would be best to remember that the lender’s assessment of the property you want to buy is an integral part of the underwriting process. So, if the appraisal reveals property value, condition, or marketability issues, the mortgage application is likely to be denied.

To avoid mortgage denial after approval, you must ensure that the property you select is in good condition, meets the lender guidelines, and can serve as sufficient collateral for the loan. In addition, you also need to note that certain property types might be deemed ineligible for financing by the lender, such as non-warrantable condominiums or homes in high-risk areas.

You were never pre-approved. In some cases, it could be a matter of a misunderstanding where a borrower believed they were pre-approved, but in reality, they were not. These cases arise when there is a lack of communication or even shared knowledge between the borrower and the lender.

What Is The Difference Between Pre-Qualification Versus Pre-Approval

Moreover, it’s quite common for borrowers to misunderstand between pre-approval and pre-qualification. Like in other fields, there is much jargon in the real estate sector, and separating the difference between some words can be quite challenging.

When a lender uses pre-approval during the process, even when he may be referring to pre-qualification, it is very easy for the borrower to take it literarily. So, it is very important for the borrower always to seek clarification on such matters to avoid misunderstandings, especially when you are in doubt—top tips to ensure that your loan application isn’t denied after pre-approval.

Not all mortgage lenders issue the same type of pre-approval. Some loan officers will not run the file through the automated underwriting system and issue the pre-approval letter. Consider paying down or paying off your credit cards, but remember not to close any account, as this would hurt your credit score.

Mortgage Denial After Approval Due To opening new lines of credit

Using cash to make payments would be the safest option until you close your home. This way, you will; avoid the risk of messing up your credit report, especially unintentionally or without knowing. Keep paying off your debts to prevent them from growing and ensure they are in control. John Strange, a senior loan officer at Mortgage Lenders For Bad Credit, advises not to open new credit during the mortgage process:

The truth is, as the debt grows, so are the interest rates, and this will increase the amount you will be needed to pay, which will, in turn, affect your debt-to-income ratio. Avoid making large money movements in and out of your accounts. Keep saving money, as you might need to during the closing process. Provide all the requested documents on time.

What Are My Next Steps After Getting Mortgage Denial After Approval From Mortgage Underwriter

As we conclude, the journey from mortgage pre-approval to the final closing process is a path fraught with uncertainty and challenges, with a denial of a real possibility. Let’s face it, the bitter reality of a mortgage denial after approval can be disheartening and frustrating for prospective homeowners. However, it is essential to approach this setback as an opportunity for growth and a chance to better understand the complexities of the mortgage underwriting process. Angie Torres is the National Operations Director at Mortgage Lenders For Bad Credit. Angie says over 80% of our clients at Mortgage Lenders For Bad Credit are folks who could not qualify at other lenders. Here is what Angie says:

While the reasons for the mortgage denial after approval by underwriters might be diverse, as outlined in the article, you must remain resilient and proactive as a borrower. Also, by recognizing these reasons, you can take steps to mitigate the risks, improving your chances of securing the mortgage.

On the other hand, if you have experienced mortgage denial, it is important to take action to address the underlying issues and strengthen your financial profile. You can start by re-evaluating your goals, refining your approach, and creating a stronger foundation for your next application. With persistence, determination, and a willingness to learn from the past, borrowers can use their denial experience as a catalyst for future success. By taking these steps, you can recover from a mortgage denial and increase your chances of approval.