Non-Conforming And Portfolio Loans And Requirements

This BLOG On Non-Conforming And Portfolio Loans And Requirements Was UPDATED On May 3rd, 2019

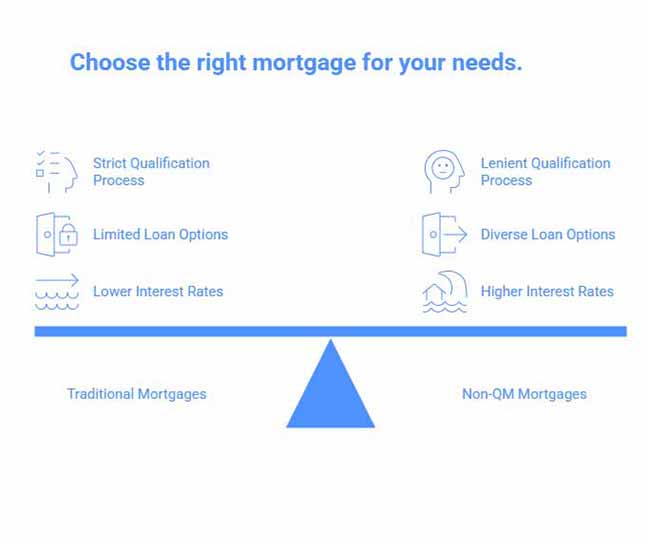

Conforming loans are 30 year fixed rate residential mortgage loans that conform to Fannie Mae and/or Freddie Mac conforming mortgage lending standards. Portfolio Loans are also called non-conforming loans.

- In order for Fannie Mae and Freddie Mac to purchase conventional loans from private, mortgage loans need to meet and conform to Fannie/Freddie Guidelines

- Lenders want to sell closed and funded loans on the secondary market

- Mortgage loans originated by lenders need to meet the guidelines set by Fannie Mae and/or Freddie Mac

- All loans that do not conform to Fannie Mae and/or Freddie Mac Guidelines are called portfolio loans and/or non-conforming loans

Fannie Mae And Freddie Mac Conforming Loans

Fannie Mae and Freddie Mac are the two mortgage giants who set mortgage lending standards.

- Lending guidelines and standards set by Fannie Mae and Freddie Mac are referred to as conforming to Fannie Mae and Freddie Mac

- In order for a lender to be able to sell the mortgage loans that they originate, they need to conform to Fannie Mae or Freddie Mac’s guidelines

- For example, here is a case scenario:

- with condominium loans

- for a condominium buyer to be able to get a condominium loan with 5% down payment, the condominium complex needs to be 51% or more owner-occupied in order to meet conforming standards

- If it is not 51% or more owner-occupied and the condominium complex is 51% or more rental units, the condominium unit buyer cannot qualify for a conforming loan

- This is because it does not conform to Fannie Mae or Freddie Mac mortgage guidelines

- Any mortgage loans that are not conforming, are called non-conforming loans or portfolio loans

- Non-conforming loans cannot be sold to Fannie Mae or Freddie Mac

- Mortgage lenders who originate and fund non-conforming loans are called portfolio lenders

What Are Portfolio Loans And Non-Conforming Mortgages

Portfolio lenders are lenders who do not sell the loans they originate to Fannie Mae or Freddie Mac.

- Most portfolio lenders keep the mortgage loans they originate

- They fund the loans and keep in their own books until they mature

- Portfolio lenders set their own lending guidelines

- Normally require larger down payments

- Normally cannot have private mortgage insurance and need to protect their assets

- Condotel financing, non-warrantable condo loans, Jumbo loans, non-qm loans, bank statement loans, and unique property loans are examples of portfolio loans

Types Of Portfolio Loans

Jumbo loans up to $3,000,000 are portfolio loans that are available with 20% down payment to qualified Jumbo Mortgage loan applicants.

- Minimum credit score required is 680

- Maximum debt to income ratio caps is set at 40% DTI

- Traditional Jumbo mortgage with 10% down payment is available to borrowers with credit scores of 740 and debt to income ratios no greater than 40% LTV

- Gustan Cho Associates Mortgage Group are experts in non-qm loans where there is no waiting period after housing event and/or bankruptcy

- Bank Statement Mortgage Loans for self-employed borrowers where no income tax returns are required are portfolio loans

Asset Depletion Mortgages

Asset depletion program is for borrowers who do not have documented income but have documented assets.

- Asset depletion loans is a form of no income and/or no doc loan program

- Lenders use 5% of the assets as annual income for income qualification purposes

- The asset depletion program is ideal for those borrowers who have no income via traditional income but have assets

- For example, here is a case scenario on asset depletion:

- if a borrower is retired

- has $2,000,000 in retirement or investment account

- 5% of the $2,000,000 or $100,000 can be used as annual income to qualify for debt to income ratios

Expatriate And Foreign National Mortgage Loan Programs

Foreign nationals normally cannot qualify for conforming mortgage loans.

- Our expatriate and foreign national loan program now offers financing to foreign nationals who do not have a green card but has a valid work permit and is employed by a company in the United States or a U.S. subsidiary of a foreign company

- No credit scores are required

- No credit tradelines are required either

- Minimum down payment for expatriate and foreign national mortgage loan program is 20% down payment and one year of reserves

Condotel Financing

Condotel Financing is now available.

- Condo Hotel Mortgage Loans are all portfolio loan programs

- Condotel Loans are 30-year mortgage loans

- Only available as adjustable mortgage rates; 3/1 ARM, 5/1 ARM, and 7/1 ARM

- Minimum loan size is $100,000

- Condo hotel unit needs to have at least one bedroom and a full kitchen and be at least 500 square feet

- 25% down payment is required for primary and second home condotel mortgage loans

- 40% down payment is required for investment condotel mortgage loans

- One year reserves are required for the primary residence as well as the proposed new condotel unit

- The minimum credit score of the borrower that is required is 680

- Maximum debt to income ratio is at 40%

- Potential rental income cannot be used for debt to income qualification purposes

Non-Warrantable Condominium Financing

Financing on a non-warrantable condominium, the minimum down payment required is 20% down payment and need a credit score of 680:

- One year of proposed housing payment is required as reserves

- Maximum debt to income ratio cap is 40%

- Non-warrantable condominiums are condos that do not qualify under conforming lending guidelines

- This is due to having 51% or more of the condominiums in the complex as rentals and non-owner occupants

NON-QM And Bank Statement Mortgage Loans For Self Employed Borrowers

NON-QM Loans do not have a mandatory waiting period after housing event and/or bankruptcy. Bank Statement Loans for self-employed borrowers do not require any income tax returns. 24 months of bank statement deposits are averaged to derive monthly income. 10% to 20% down payment is required. Down payment requirements depends on borrowers credit scores. Gustan Cho Associates Mortgage Group has NON-QM Jumbo Mortgages with no tax returns required and credit scores as low as 620. Contact us at 800-900-8569 or text us for faster response.