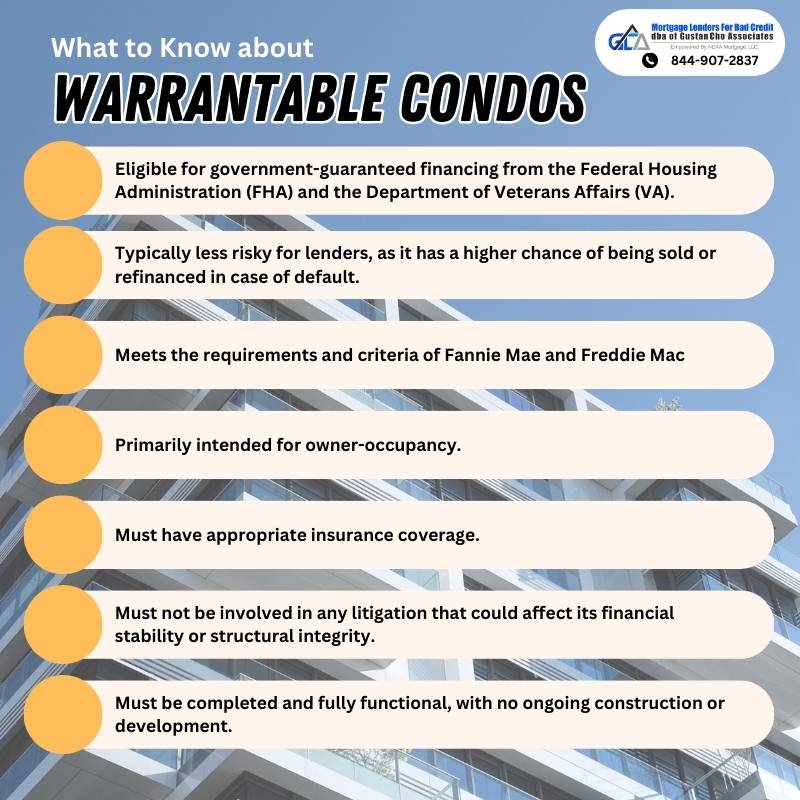

Warrantable Condos

This guide covers warrantable condos and a secure path to condominium financing. Concerning condo financing, warrantable condos provide potential buyers with a smoother and more straightforward path. These condos meet the eligibility criteria set byFannie Mae and Freddie Mac, the leading government-sponsored enterprises. John Strange of Gustan Cho Associates explains the difference between non-warrantable and warrantable condos as follows:

There is no difference between warrantable condos and non-warrantable condominiums with the exception of owners living on the condo complex. Warrantable condos are condominium units where over 50% of the occupants are owners occupying the condo complex.

This article will explore the key characteristics of warrantable condos, their benefits to buyers, the financing process involved, and important considerations for prospective condo owners. With a firm grasp of warrantable condos, you can confidently navigate the condo market and secure the financing you need for your dream home.

Definition of Warrantable Condos and Importance of Warrantability

Warrantable condos are condominium units that meet specific eligibility criteria set by Fannie Mae and Freddie Mac. These criteria ensure the condos’ stability, marketability, and compliance, making them eligible for traditional mortgage financing. Warrantability is crucial for condo financing because it enables potential buyers to access traditional mortgage loans with more favorable terms and interest rates. Lenders view warrantable condos as less risky investments due to their adherence to specific criteria, providing confidence and security to both lenders and buyers. Understanding the importance of warrant ability helps buyers navigate the condo market and secure the financing they need for their dream home.

Characteristics of Warrantable Condos

Eligibility criteria set by Fannie Mae and Freddie Mac: Warrantable condos meet the specific eligibility criteria established by Fannie Mae and Freddie Mac. These criteria are designed to ensure the stability and marketability of the condos in the mortgage market. Meeting these criteria enables potential buyers to access traditional mortgage loans with more favorable terms and interest rates.

Typical characteristics of warrantable condos

Warrantable condos are primarily intended for owner-occupancy, meaning that most of the units are occupied by the owners rather than used as rental properties or vacation homes. Lenders prefer condos where residents are vested in maintaining the property’s value and ensuring a sense of community.

Warrantable Condos Limited investor ownership Guidelines

Warrantable condos typically restrict the percentage of units owned by investors. This is to maintain a healthy balance between owner-occupants and investors, reducing the risk of speculative behavior or excessive rental properties within the community. Lenders prefer a majority of units to be owned by primary residents.

Warrantable condos must have appropriate insurance coverage to protect against fire, natural disasters, and liability claims. Lenders require evidence of adequate insurance coverage to ensure that the property and its occupants are protected in case of unforeseen events.

The homeowners association (HOA) plays a vital role in managing and maintaining the condo community. Warrantable condos typically have an HOA that demonstrates financial stability. This includes having sufficient reserve funds for ongoing maintenance and repairs and sound financial management practices.

Warrantable Condos ongoing litigation Guidelines

Warrantable condos should not be involved in any ongoing litigation or legal disputes that could potentially impact the value or marketability of the property. Lenders want to ensure that no significant legal issues could affect the borrower’s ability to repay the loan or the property’s marketability.

Warrantable condos must meet certain physical and legal requirements. The condo development must conform to local zoning regulations and building codes. The units should have clear and marketable titles, and there should be no legal barriers or encumbrances that could hinder the transfer of ownership.

By meeting these typical characteristics, warrantable condos provide stability, ensuring buyers have confidence in their investment and lenders can mitigate their risk. Understanding these criteria and characteristics is crucial when considering financing options for a condo purchase. The benefits of financing a warrantable condo extend beyond the ease of access to traditional mortgage loans. Lower interest rates, more favorable loan terms, increased marketability, and assured quality standards contribute to a positive homeownership experience and potential financial gains. It is essential for prospective buyers to consider these benefits when exploring condo financing options.

Benefits of Warrantable Condos Easier access to traditional mortgages

One of the primary advantages of financing warrantable condos is the increased availability of traditional mortgage loans. Since warrantable condos meet the eligibility criteria established by Fannie Mae and Freddie Mac, lenders are more willing to provide financing for these properties. This broader range of financing options makes it easier for potential buyers to secure a mortgage and fulfill their homeownership goals.

Warrantable condos often qualify for more competitive rates and favorable loan terms than non-warrantable condos. Lenders view warrantable condos as less risky investments due to their adherence to specific criteria and characteristics. As a result, borrowers may enjoy lower interest rates, reduced monthly payments, and potentially significant savings over the life of the loan.

Financing a warrantable condo enhances its marketability and potential resale value. Buyers in the real estate market generally prefer warrantable condos as they offer stability and compliance with industry standards. When it comes time to sell the property, having a warrantable status can attract more buyers and lead to a quicker sale at a favorable price.

Assured quality and compliance standards

Warrantable condos are subject to specific eligibility criteria and characteristics, ensuring quality and compliance. These criteria may include primary residence occupancy, limited investor ownership, insurance coverage, stable HOA finances, absence of ongoing litigation, and adherence to physical and legal conformity. Buyers can have confidence in the property’s structural integrity, legal compliance, and overall market viability by financing a warrantable condo.

Warrantable Condos Mortgage Process

Throughout the underwriting and loan approval process, lenders carefully evaluate borrowers’ financial standing, creditworthiness, and the value of the warrantable condo. This comprehensive assessment helps lenders decide on loan approval, interest rates, and terms. Engaging traditional lenders: Engaging traditional lenders, such as banks, credit unions, and mortgage lenders, is the crucial first step in securing financing for a warrantable condo, as these institutions possess the expertise and resources to navigate the complex mortgage process.

Financing Warrantable Condos at Banks, credit unions, and mortgage lenders

When financing a warrantable condo, borrowers typically engage with traditional lenders such as banks, credit unions, or mortgage lenders. These institutions have experience and expertise providing mortgage loans for various properties, including warrantable condos. Guidelines based on Fannie Mae and Freddie Mac requirements: Traditional lenders follow the guidelines established by Fannie Mae and Freddie Mac for warrantable condos. These guidelines outline the eligibility criteria and characteristics condos must meet to be considered warrantable. Lenders use these guidelines to evaluate loan applications and determine eligibility.

Warrantable Condos Documentation and verification

Documentation and verification play a pivotal role in the warrantable condo financing process, ensuring that borrowers provide accurate and comprehensive information about their financial status and the condo association’s documents to enable lenders to make informed decisions. Borrower information and identification:

To initiate the financing process, borrowers must provide personal information and identification documents. This includes details such as name, address, Social Security number, and proof of identification, such as a driver’s license or passport.

Lenders require borrowers to provide documentation to verify their financial standing. This typically includes recent pay stubs, W-2 forms, and tax returns to demonstrate income stability and affordability. Additionally, borrowers may need to disclose information about their assets, such as bank and investment account statements. Documentation of existing debts, such as credit card balances, car loans, and student loans, is also necessary for a comprehensive financial assessment.

Warrantable Condos HOA association documents (by-Laws, financial statements)

Lenders require access to relevant condo association documents as part of the financing process. These may include the condo association bylaws, financial statements, budgetary information, and community rules and regulations. Lenders review these documents to ensure

the condo association is financially stable, adequately funded, and complies with the

necessary regulations.

The underwriting and loan approval process is a critical stage in warrantable condo financing, where lenders carefully evaluate borrowers’ financial credentials, creditworthiness, and property value to determine the feasibility and terms of the loan.

Lenders assess the creditworthiness of borrowers by evaluating their credit scores. A higher credit score demonstrates a history of

responsible financial behavior and indicates a lower risk for lenders. A thorough review of the credit report helps lenders determine the interest rate, loan amount, and other loan terms.

Warrantable Condos Income and employment verification Guidelines

Lenders verify borrowers’ income and employment to assess their ability to repay the loan. This involves confirming employment details, income stability, and consistency. Lenders may contact employers, request additional documentation, or utilize third-party verification services to validate income information.

Warrantable Condos Appraisal and property value assessment Guidelines

Lenders require an appraisal of the warrantable condo as part of the loan approval process. A professional appraiser evaluates the property’s value based on various factors, including its location, size, condition, and comparable sales. The appraisal helps determine the maximum loan amount and ensures the property’s value aligns with the sought loan.

Warrantable Condos Debt-to-income ratio analysis

Lenders assess borrowers’ debt-to-income (DTI) ratio to evaluate their ability to manage debt payments. The DTI ratio compares borrowers’ monthly debt obligations to their gross monthly income. Lenders typically have maximum DTI ratio requirements, and a lower DTI ratio indicates a lower risk for lenders.

When exploring the purchase of a warrantable condo, buyers must be aware of key considerations that can significantly impact their ownership experience. Understanding factors such as HOA fees, condo association rules, financial health, and potential resale restrictions empowers buyers to make informed decisions and ensure a successful condominium purchase.

Warrantable condos are typically governed by a homeowners association (HOA) that imposes monthly or annual fees on condo owners. Buyers need to understand the purpose and amount of these fees, as they contribute to the maintenance and upkeep of common areas, amenities, and building exteriors. Buyers can properly budget homeownership expenses by comprehending the HOA fees and obligations.

Reviewing condo association rules and regulations

Condo associations have specific rules and regulations that govern the conduct of residents within the community. It is crucial for buyers to thoroughly review these rules to ensure they align with their lifestyle and preferences. Considerations may include pet policies, rental restrictions, noise regulations, parking rules, and architectural guidelines. Understanding and accepting these rules beforehand can help prevent future conflicts or surprises.

Buyers should conduct due diligence on the condo association’s financial health before purchasing a warrantable condo. This involves reviewing the association’s financial statements, budget, and reserves. A financially stable association indicates the ability to maintain and repair common areas and unexpected fund expenses adequately. Buyers should look for signs of a well-managed association with sufficient reserves to handle future maintenance and repairs.

Resale restrictions can impact a buyer’s ability to sell the condo. Some condos have limitations on who can purchase within the community, such as age restrictions or specific occupancy requirements. Buyers should evaluate these restrictions and consider their potential impact on the resale value and marketability of the condo.

Benefits of Financing Warrantable Condos

Understanding any limitations can help buyers make informed decisions about their long-term plans. Considering these important factors, warrantable condo buyers can make informed decisions and ensure a smooth transition into their new community. Understanding HOA fees and obligations, reviewing condo association rules, conducting financial due diligence, and evaluating potential resale restrictions are crucial steps to ensure a successful and satisfying homeownership experience.

Navigating the world of warrantable condos requires careful consideration of various factors, from eligibility criteria and financing options to the characteristics and benefits they offer.

By understanding the financing process, engaging with traditional lenders, providing necessary documentation, and undergoing the underwriting process, buyers can secure favorable loan terms for their warrantable condos. Additionally, being aware of HOA fees, association rules, financial health, and potential resale restrictions allows buyers to make informed decisions and enjoy a smooth homeownership experience. With thorough research and thoughtful consideration, buyers can confidently embark on their journey to owning warrantable condos.